Purchasing Bitcoin and other cryptocurrencies on your own comes with risk. Here are the five most common cryptocurrency scams reported by customers of Bitcoin Wallet Recovery Services:

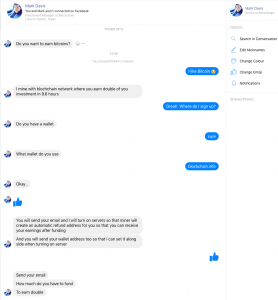

1: Fake mining contracts: “mining contracts” which offer fantastic payouts, such as doubling your money in 10 hours (see screenshot below). After sending the “mining company” Bitcoin, they either disappear or ask for more money to unlock funds. Some “mining services” send a public address as proof of payment, or hold “mining profits” in a web wallet which cannot be withdrawn from. Legitimate mining contract marketplaces such as Nicehash are extremely risky and complex, and do not make sensational claims about quick profits.

2: Malicious wallet software: wallet software that sends private keys to a central server, which steals the victim’s coins. “Electrum Pro” was a notorious example, as electrum.org is a real wallet, and electrum.com hosted a malicious wallet which stole victim’s Bitcoin. The most secure wallets are physical hardware wallets such as the Trezor and Ledger.

3: Fake forking services: services which promise to help users claim their forked Bitcoin Cash, Bitcoin Gold, Bitcoin Private, etc. Once the seed or private keys were entered, they disappear with the funds. Some customers had Bitcoin stolen from their hardware wallets because they did not realize that their recovery seed could be used to steal their Bitcoin. The only safe way to claim a Bitcoin fork is to move your Bitcoin to a new wallet first!

4: Fraudulent exchanges: Many people are confused about where they store their legitimately purchased Bitcoin, or how Bitcoin is created and distributed. Malicious vendors take advantage of them by either claiming to sell cryptocurrency or simply announce that the recipient has coins which they forgot to claim. In some cases, they act like an advance-fee scam, where the victim has to pay upfront to collect their non-existent wallets. In other cases, the exchange takes payments (usually a credit card) for Bitcoin but makes withdrawing Bitcoin to a private wallet difficult or simply obscure. Many people are not aware of the importance of holding their own private keys, and leave their wallets with a third party for years until it disappears (as with Mt Gox).

5: Wallets for sale: scammers who sell cryptocurrency wallets with contents that are not spendable. Sometimes wallets are sold with the claim that the owners “forgot” the password for 5% of the value. (Many people assume that all cryptographic passwords can be broken if with enough skill, persistence, or hardware and ask me to do the hard work.) In other cases, wallets are sold by to buyers who do not realize that the proper way to transfer cryptocurrency to their personal address. Until very recently, Blockchain.info would reflect the watch-only (only the public address is stored) addresses in the total balance, which enabled the fraudulent sale of thousands of empty wallets with watch-only addresses. The only safe way to purchase Bitcoin is to have the seller transfer it to an address from your own wallet, under your exclusive control.

Want to keep your Bitcoin stash safe? Read “11 Essential Security Practices to Keep Your Bitcoin Secure from Hackers and Thieves”:

11 Essential Security Practices to Keep Your Bitcoin Secure from Hackers and Thieves

Bitcoin mining scam